Should You Use an Investment Banker When Selling Your Company?

Updated on January 18th, 2019 | By Anthony Glomski  | Leave a Comment

| Leave a Comment

When it comes to selling a business, a new crew of critical players start to emerge, or we at least we hope if things are going right. A key team member may be the Investment Banker, or “I-Banker”. Part of our role when we work with our clients is to vet these professionals and they are one of the many important team members I discuss in my book, Liquidity & You. They come in many flavors, but from my personal experience, their expertise in packaging and marketing your business can make a massive impact in the final result – assuming you’ve chosen correctly. The following article crafted by my colleagues at AES Nation identifies much of what you need to know to make the right decision.

Key Takeaways:

- Investment bankers bring knowledge of potential buyers for a business along with expertise at structuring and negotiating business deals—often leading to more money for the seller.

- When selecting an I-banker, assess both the individual banker and the firm he or she works for.

Selling your business is one of the most important, complex and emotionally challenging experiences you’re likely to face as an entrepreneur. You’ve got one chance to get it right—there are no do-overs—so you’ve got to play it smart.

That’s probably why we see so many business owners seeking out professionals such as investment bankers, business brokers and other specialists to help guide them through the pre-sale, the transaction itself and even some post-sale decisions.

“If you’re preparing to sell your company—or even if you think a sale is possible at some point down the road—you should consider whether it makes sense to join your peers and enlist an investment banker.”

CLICK TO TWEET

Why Use an I-Banker

While it is certainly possible to sell your company entirely on your own, it’s very likely that an investment banker on your side will result in better deal terms, a higher sale price or both. Indeed, those are the main reasons so many business owners seek out I-bankers.

For example: In one study, 84 percent of the surveyed group—business owners who sold their businesses with the help of investment bankers for between $10 million and $250 million—said the final sale price was equal to or higher than the banker’s initial sale price estimate.

There are many reasons why these results occur. I-bankers tend to possess knowledge and skills in key areas that help you get better results than you could achieve on your own. Key skills they bring to the table include:

- Industry expertise. Knowing your industry and the various players within it can enable investment bankers to identify more potential buyers.

- Knowledge of possible buyers. They know what different companies are looking for and the types of deals they are likely to make. This can give you more choices as well as greater negotiating leverage. They can also find buyers anonymously, thereby protecting your confidentiality as the seller.

- Creating financial models and marketing materials. As part of their work in selling a company, investment bankers will develop extensive financial models—explaining, for example, valuation. They will also construct pitch books and other marketing material.

- Structuring the sale. There are different ways to structure a deal, such as incorporating an earn-out for the owner or the deal being an asset sale. An investment banker can be instrumental in determining the appropriate structure.

- Screening potential buyers. The investment banker can separate the wheat from the chaff by identifying the really interested, legitimate candidates to purchase your company.

- Negotiating the sale. Using competent experienced professionals to bargain on your behalf can be very effective in making sure you get the best sale price.

- Providing an objective and realistic assessment of the opportunities. Sometimes business owners get very emotionally wrapped up in the sale of their companies and along the way become somewhat unrealistic about the end result. Investment bankers can be important “reality checks.”

Pro tip: Enlisting an I-banker can be a good idea even if you have already identified one or more potential buyers and don’t need help in that area. For example, say you lack experience in business sale transactions. You might end up with a subpar deal if you do it all yourself. What’s more, an I-banker can find additional potential buyers apart from the ones you know—and create a competitive situation that could lead to a higher sale price for you.

Access the Top 10 Wealth Planning Strategies for Successful Entrepreneurs

Access the Top 10 Wealth Planning Strategies for Successful Entrepreneurs

Size Can Matter

There’s an important caveat to working with an I-banker: These professionals tend to add the most value for owners of businesses valued at $1 million or more. And the greater the valuation above $1 million, the more likely engaging an investment banker would be a smart move. For example:

- Just two out of five corporate attorneys involved in the buying and selling of companies believe that using an investment banker would be a very good idea if the firm is valued at less than $1 million.

- But more than nine out of ten corporate lawyers advocate using an investment banker if a company is worth between $1 million and $10 million.

- All the corporate attorneys surveyed report that selling a company worth more than $10 million would benefit from the inclusion of an investment banker on the team (see Exhibit 4).

Exhibit 4

Strongly Recommend Using an Investment Banker

- Valued less than $1 million 41.1%

- Valued from $1 million to $10 million 91.6%

- Valuation greater than $10 million 100%

N = 107 corporate attorneys. Source: AES Nation, 2018.

Selecting an Investment Banker

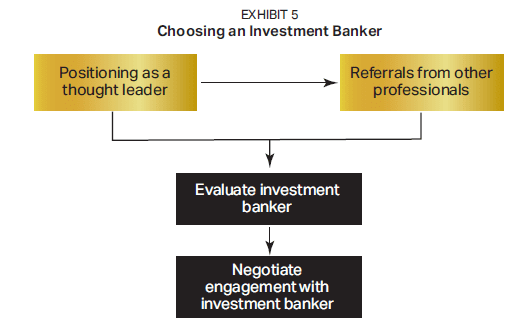

If you decide that engaging an investment banker is a good idea, you’ll need to find talented investment bankers who are likely to be a good fit for you and your company. The factors that often determine the selection of an investment banker are shown in Exhibit 5.

Most investment bankers for private companies are referred by other professionals working with those company owners. Corporate attorneys, wealth managers and accountants are often recommending investment bankers to business owners who are interested in selling their companies.

Another powerful factor is the investment banker’s reputation among privately held companies. As with all high-end professional service providers, you should be looking for industry thought leaders who demonstrate their expertise regularly.

When introduced to an investment banker, you still have to take a measure of the person and the firm. One good way to do that is to examine the financial models and marketing materials they have produced for other companies. You might also ask questions such as:

-

“What transactions comparable to mine have you completed in the past three or so years?”

-

“Do you have expertise with businesses in my specific industry?”

-

“What were the sizes of these sales?”

-

“What companies were they sold to?”

-

“How do you put together your buyer’s list?

-

“How many engagements did you have over the past three years that failed to close? Why?”

-

“What do you see as your role in the sale?”

Engaging With an Investment Banker

Once you have selected a banker to work with, you should negotiate the engagement. According to all the corporate attorneys surveyed, it is a potentially big mistake not to negotiate an investment banking agreement (see Exhibit 6). And about a sixth of the corporate attorneys reported that, in their experience, failing to negotiate the agreement (or not properly understanding it) resulted in litigation within the last five years.

Exhibit 6

Negotiating the Investor Banking Agreement

- The investment banking agreement should always be negotiated 100%

- Failing to do so or properly understanding it has resulted in litigation 15.9%

Source: AES Nation, 2018. N = 107 corporate attorneys.

- Having an excessively long time frame during which the investment bank has exclusive rights. Sometimes, for example, an investment bank might ask for two years’ worth of exclusivity, when six months is the norm.

- Paying the same commission for the investment banker to raise debt (easier to do) as to raise equity (harder to do).

Next Steps to Consider

Relying on talented, experienced professionals to help you deal with financial transactions where you lack expertise—such as selling your company—is often a very good idea. Remember, one of the main reasons for using an investment banker is to get a better price for your company—and research suggests that I-bankers do a good job at this task.

If you think that an investment banker would be helpful, you need to connect with a high-caliber professional—by which we mean one who has the requisite skills and experience, and who also understands the specific dynamics of your industry and companies of your size. That said, it’s important to vet anyone you work with on a sale—and that means, among other things, being crystal clear on the arrangements you make with any banker and the terms of the engagement.

If you think you could potentially benefit from working with an investment banker to prepare your company for a sale and guide you through the transaction, reach out to us at info@agassetadvisory.com or visit AG Asset Advisory to explore the topic further.

0 Comments

Submit a Comment

Meet Anthony

Anthony Glomski is the founder of AG Asset Advisory, an internationally recognized SEC-registered Family Office. His team works extensively with entrepreneurs so they don’t miss out on any potential opportunities and they get the results they want. This collaborative process addresses an array of family, financial, and lifestyle concerns along with coordination and oversight of various professionals to keep everyone focused tightly on their goals.

0 Comments

Submit a Comment

Work With Us

Contact:

Our Mission:

We design bespoke wealth planning strategies and customized solutions for highly successful entrepreneurs that avoid missing potential opportunities and achieve the outcomes you want.

Meet Anthony

Anthony Glomski is the founder of AG Asset Advisory, an SEC-registered Family Office. His team works extensively with successful entrepreneurs so they don’t miss out on any potential opportunities and get the results they want. This collaborative process addresses an array of family, financial, and lifestyle concerns along with coordination and oversight of various professionals to keep everyone focused tightly on their goals.